Spin-off Guide

This page contains a detailed how-to guide to get you started if you're interested in building a spin-off company arising from UBC research, with many pointers to additional resources.

The founders and IP Agreement

Generally, companies based on research are formed under one of the following scenarios:

| Scenario | Considerations | Actions |

|---|---|---|

| Trainee (student or postdoc) decides to start a company based on research performed at UBC; faculty members decide to stay involved as advisors or with an equity-stake in the company |

|

|

| Trainee (student or postdoc) decides to start a company unrelated to research performed as part of studies at UBC/done at UBC; faculty members decide to stay involved as advisors or with an equity-stake in the company |

|

|

| Faculty member partners with an external partner (incubator, company) to exploit company or build a company around IP |

|

|

Registering your company

Registration and Incorporation

You can register your company provincially or federally. Incorporation typically requires a few steps:

- Determining your business structure and board of directors (you should think about this before you start the process)

- Name search (to make sure your business name is unique)

- Establishing the company’s Articles of Incorporation with the following minimum information (standard articles are provided by the government; additional terms may be amended later):

- Company name

- Records Office information

- Director name, address

- Authorized share structure (use standard: no maximum for each class)

- Application to incorporate

- Record book created, including articles of incorporation and minutes/resolutions from the Board of Directors

- Post incorporation

- Share issuance

- Shareholder agreement

- Shareholder resolutions

- Registered office and a records office in British Columbia

- Electronic Record Book updated and signed

You can go through this process yourself (the process is done completely online). Federal incorporation costs $200 while the provincial process in BC costs $350 if done by yourself.

Alternatively, you can use one of the services below to complete it for you:

- Ownr (https://www.ownr.co/)

- Snap Incorporation (https://business-incorporations.ca/)

- Good Lawyer (https://www.goodlawyer.ca/)

These services can support (with customization of) the articles of incorporation, which can be important during the process.

At the end of this step, you will know the company name, business number and incorporation date.

CRA registration required

To be able to start operations, you will need to register for a CRA My Business Account. You can register for an account using your business number and personal SIN number, and provide access to others. Depending on the business's activities, you should ensure you have the right CRA program accounts set up. The most important ones are:

- RT, Goods and Services tax/harmonized sales tax

- RP, Payroll deductions

- RC, Corporate income tax

WorkSafe BC

If you hire workers in BC, you are required to register for WorkSafeBC insurance coverage. You can set this up on the WorkSafeBC website. They will send you documentation of the coverage, including your rate information (usually 0.2% for newly payable on total payroll up to a limit; the rate depends on the theme of activities your company undertakes).

Summary (company information sheet)

You will regularly need to refer to the information below, so make sure to have them handy:

- Full legal name

- Location of Incorporation

- Incorporation date

- Incorporation number

- Business number

- Business number for corporate income tax

- Business number for GST/HST

- Business number for import

- Business number for payroll deductions

- Company address

- Registered office address

- Records office address

What you need to do every year

- Annual report

- Annual tax filing

First things you need

Graphic Content

You will want to set up a logo and templates for documents, business card and other items early on before you move forward with your company. You could try:

- Vistaprint design

- Clubcard

- Upwork

- Fiver

- Guru

- Search for freelance graphic design

You could also use the following tools for DIY:

Website, email, social media

You can get a website and email service very easily these days. To register your domain, an easy option would be Google Domains. Google Domains allows you to also pay for hosting services online. Other services many people use are Wix, Squarespace, and webflow, although you can host your websites on services like HostPapa and hostripples as well.

You would need a collaborative suite for your company to make sure you have a central repository of all information and to use it for email communication as well. Options include:

- A Google workspace which you can easily set up with google domains

- A Microsoft Office 365 account (necessary if your business plan relies on contracting with the Government of Canada)

- Zoho Workplace

- Basecamp + self-hosted email

When you expect to start generating content, adding social media is a good idea. Make sure you are on the common social media platforms (Twitter, YouTube, LinkedIn, Instagram and Facebook). Use Mailchimp to build newsletters and targeted advertising.

Office/mailing address

Depending on the situation, you may either need to find an office or a mailing address for your company. You can start by using your own mailing address, or use services like ipostal1 or UPS to get a virtual mailing address.

If you are part of an incubator program, you may be able to secure a local office. The next step would be looking for a 'coworking space' such as L’Atelier Vancouver, HiVE Vancouver or Spaces.

Bank account

At a minimum, your business will need a business chequing account. In most cases, you can also get a business savings account for free.

In BC, banks need to verify your company’s list of shareholders as part of opening a bank account, so make sure that information is accessible.

In addition to a bank account, if you foresee working with foreign contributors, you can create a Wise Account. You can use a Wise Account in place of a chequing account; however, note that some organizations such as the Government of Canada might not accept it.

Insurance

Talk to a commercial insurance broker about the following types of insurance:

- Property and liability insurance. Property insurance covers loss of business assets such as buildings, inventory, materials, equipment, and furniture. Comprehensive general liability insurance covers injuries and property damage that occur due to a company’s negligence on its premises or involving an employee. It also covers damage that a customer experiences due to your defective product or work. You need both when taking out loans.

- Business interruption insurance. If a fire or other calamity forces your company to temporarily stop operations, business interruption insurance covers your lost income.

- Life and disability insurance. You need this for yourself and future workers.

- Professional liability insurance. If your profession requires it, purchase professional liability insurance.

By talking to a broker, you can produce a combined commercial insurance (business owner’s policy) that would include the above coverages and others you might need.

Payroll and accounting systems

You will need a payroll and accounting system to track your employees and expenses. Note that some government funding programs require you to have such a system in place before you access funding from them. Recommended systems include:

- Wave: A Canadian provider supporting accounting, invoicing, payments, and payroll. Base services are free with fees for payroll and payments.

- Odoo: A larger set of services, but all require a subscription

- Gusto: Online payroll and benefits system

- Xero: A popular accounting tool with some payroll functionality

- Intuit Quickbooks: A popular accounting tool with some payroll functionality

Recruiting

Here are a few things you'll need to consider as you explore bringing others onboard:

- Full-time/part-time employment

- Independent contractors

- Confidentiality/non-disclosure agreement

- Equity incentive plan

If you are looking for freelancers, these are some useful sources:

Law and accounting firms

Hire a lawyer and accountant as early as possible to make sure you do everything by the books. They can provide the right templates to you as well.

You can use services like Goodlawyer.ca and Small Business BC advisory service as a starting point. Past ventures at UBC have contacts familiar with the type of company you are building and can help with intros as well.

The following services also provide legal information and templates:

- Docracy: Open collection of legal contracts and the best way to negotiate and sign documents online. Make sure to search for Canadian samples.

- Legal Shield: Connects you with local law firms.

Preliminary business plan

Before discussing your idea with UBC to gain access to your IP, you need to think about the commercialization path of your work. Developing a business plan would help you with this. In addition, it would help you look deep into the business idea to see if it is valid, and provide a roadmap for decision-making in the future.

Most business plans have the standard sections below:

- Executive summary

- One to two-page summary of the key points of your business plan (leave writing it to the end)

- Mission statement/Business opportunity

- What you want to happen and where you want to be some time in the future (a benchmark to assess yourself)

- The industry sector of your business

- The advantages that your business has over your competition

- The uniqueness of your product or service

- Company overview

- The legal name of the company

- The legal form of the company (sole proprietorship, partnership, corporation, or co-operative)

- The business location

- Background on key management personnel, qualifications, and their roles

- Strategic business objectives

- Your objectives should be realistic, measurable, action-oriented and related to your mission statement

- Focus on: sales, customer satisfaction, profit/growth, socioeconomic impact and diversification

- Business and market environment

- You need to be able to describe your customers, competitors, suppliers and funders

- You should also address economic trends, industry trends and community business trends

- You should describe how you're going to position your product or service (What makes it unique?)

- Marketing plan

- Sales/exit strategy: How will your products and services be sold to your customers OR how you plan to do an exit

- Pricing strategy: How would you price your services compared to your competitors and why?

- Distribution strategy: How would you distribute/give access to your product?

- Advertising and promotion: What will be your messaging and how do you get it in front of users?

- Products and services

- Describe the products and/or services you provide with a focus on the “needs” of customers

- Operations plan

- Daily operations: Create descriptions of hours of operation, seasonality of business, suppliers, and their credit terms, etc.

- Facility requirements: What is the size and location, information on lease agreements, supplier quotations and any licensing documentation?

- Management information systems: Have details for inventory control, management of accounts, quality control and customer tracking

- Information technology (IT) requirements: What are your IT systems, any consultants or support service and an outline of any planned IT developments

- Financial plan

- Conservatively forecast for the next 1-5 years: your expenditures, revenues, capital costs and profits/losses

- If you have historical financial statements (balance sheet, income statement, cash flow statement), include them for reference

- Think of financial indicators (debt-to-equity ratio, return on investment, break-even point, current asset-to-liability ratio)

- Provide a detailed capital budget outlining the assets you need (building and equipment, working capital, materials, inventory, etc.)

- Implementation plan

- Estimated dates of completion for various aspects of your business plan, targets for your business and accomplishments

- As a start-up, you want to break this down into a developmental plan (to get market-ready) and a production plan

- Appendices

- Include supporting materials, such as licenses and permits, agreements, contracts and other documentation that support your business plan

Tips:

- Remember that the person reading the plan may not understand your business and its products, services, or processes as well as you do; so, try to avoid jargon.

- It’s a good idea to get someone who is not involved in the business to read your plan to make sure they can understand it.

- Set measurable objectives so you can monitor progress.

There are several tools and frameworks that can help you with developing your business plan:

- Business Model Canvas

- VP canvas

- Strengths, weaknesses, opportunities, and threats (SWOT) analysis

- Political, economic, social, and technological (PEST) analysis

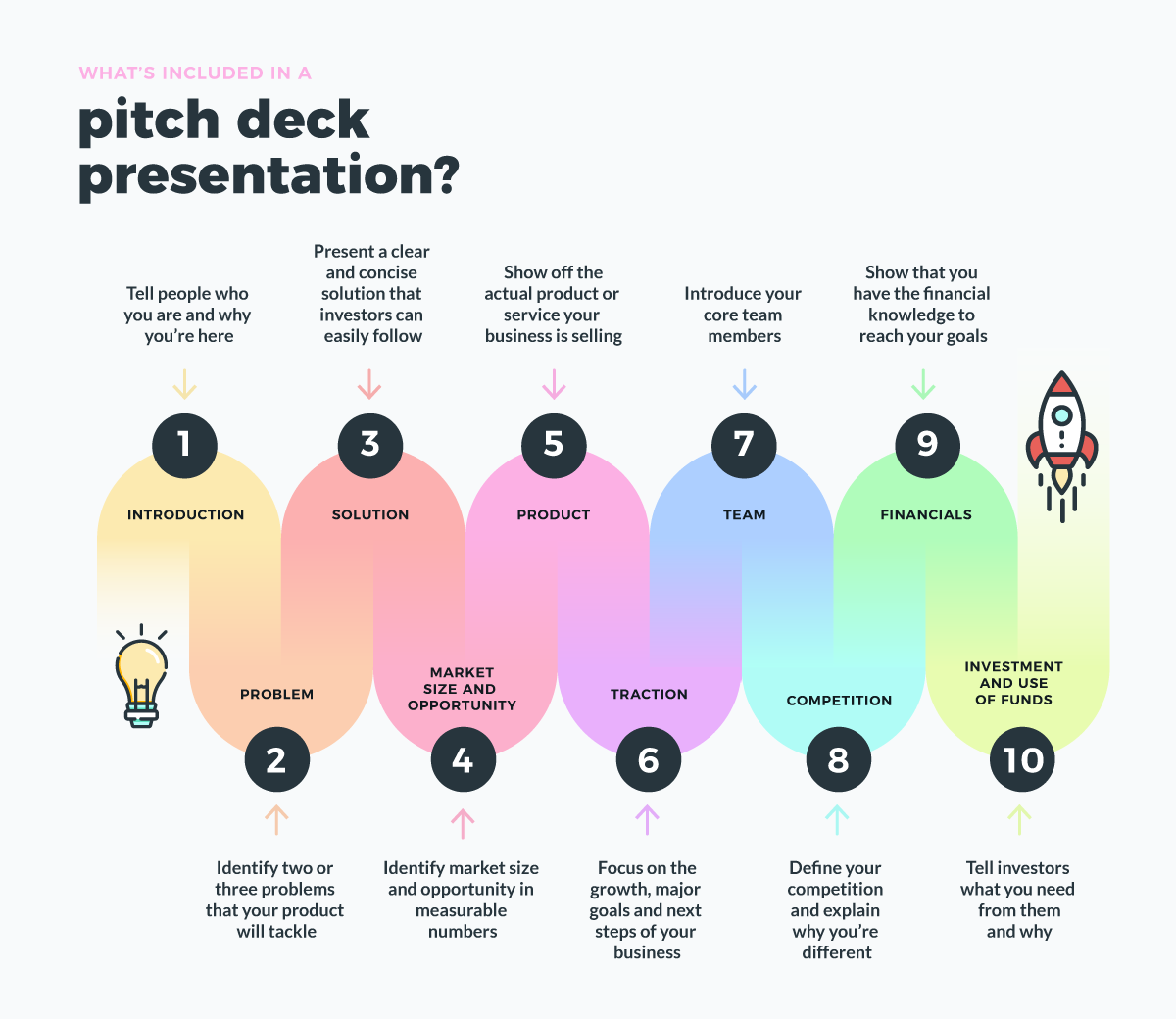

Preliminary pitch deck

A pitch deck is essential when seeking investment, including when talking to UBC about your idea to access your IP. You can see some sample pitch decks here and here.

Generally, a pitch deck should include the following elements:

- Cover slide

- Logo, name, contact info, the concept in the form of a nice high-resolution photo, and a powerful tag line (a visionary description of what you are trying to achieve; what is it?)

- Introduction (describe your business in 140 characters or less in a way your parents would understand; an elevator pitch)

- Introduce pitch deck

- Explain business in simple terms

- Outline your unique value proposition

- The problem

- The what, why, who, how, and why now (urgency)

- Framing through storytelling works well here!

- The solution

- How are you solving the problem or part of the solution?

- The best way to relay this information is through a narrative approach—provide relatable stories of customers using these products to improve their lives (with visuals to emphasize the use cases)

- The market

- What is the size of the market or potential size of the opportunity? How did you come to these numbers (metrics)? Are there well-defined market segments?

- Who is your target market? (May be a subset of the larger market)

- Who are your competitors? Who is already in the market and who is working towards it?

- What is your competitive advantage? What distinguishes you from the competitors? What is unique?

- The product

- Innovative technology

- Features and benefits

- Traction (if you have existing users, have you done testing or have you got feedback from users; if not, what is your roadmap for this?)

- Product demo (if you have one)

- Business model

- What is the basic/high-level model for acquiring customers and generating revenue or a return for investors?

- How does this compare to your competitors?

- What are your basic financial forecasts? (Burn rate, break-even point, and timeline to profitability)

- Who is involved?

- Team members

- Partners or investors

- What makes you the entrepreneur or founding team the right team to bring this together? What is your industry and business experience?

- What you need and how you will use it

- Be specific about needs (be it money, a partnership, IP, or something else)

- What are you going to do with the money or assets provided to you (timeline or breakdown)? Can you justify the use?

- Vision for the future

- Summarize the deck and state where you think you will be in a few years.

- Thank you/end slide

- Include a summary of concept and contact details.

Some tips when preparing your slides

- Think about your audience: What are they looking for? What do they want to know?

- Less is more: Do not overload your listeners; be straightforward and focus on the main points

- Focus on a story as opposed to just statistics, but do include key numbers

- Make the deck stand alone so it can also be shared in PDF format with potential investors

- Update the deck regularly as things progress

- Take your time! The deck will need frequent revisiting and revision as you learn more about the business, so start early and adjust as you move forward.

- Limit bullets: Use text and graphics; that being said, do not make slides verbose

Accessing your UBC IP

As part of accessing your research IP, you need to negotiate with the UBC University-Industry Liaison Office (UILO) to transfer an IP to your company. There are several factors that come into play:

- Does the IP already exist and is it owned by UBC?

- What is the future value of the opportunity?

- What additional IP creation opportunities exist?

- Would involving UBC (or not) impact the size of the opportunity?

You should have some idea of the answers to the above questions by developing your business plan before approaching UILO. UILO will ask to review your business plan and a description of the technology.

An assignment agreement with UILO will include the fact that UBC will give your company a fully paid-up, royalty-free non-exclusive license to you. In return, UBC will ask for a royalty (ranging from 1.5-20% of all revenue), non-dilutable equity (ranging from 1-5%), and fully paid-up, perpetual, non-exclusive license to use technology in any manner at all for research, scholarly publication, educational and all other non-commercial uses. You can negotiate with UILO on the royalty and equity stakes. The rest of the terms are very standard and not negotiable.

Initial funding

After you have set up your company and have agreements in place for use of IP, now is the time to investigate ways to raise funds. In this section, we summarize some of the programs you can tap into as a starting point.

MITACS

Mitacs has several programs that match funding from companies that work with academia:

- Accelerate fellowships These offer fellowships to master’s students, PhDs and postdocs (50% company contribution, 50% Mitacs)

- Accelerate Entrepreneur This program supports co-founders (50% company contribution, 50% Mitacs)

- Elevate This program supports postdocs with a research management component (50% company contribution, 50% Mitacs)

- Entrepreneur International This funding program supports travel costs (up to $5k) to explore new business opportunities abroad

- Business Strategy Internship Recipients receive $15k for a four-month internship (50% company contribution, 50% Mitacs)

‘Accelerate’ proposals can be submitted at any time and allow for continued research to develop solutions for the company. The proposals need to be peer-reviewed and are time consuming. Trainees will need to spend 50% of their time at the company premises during these programs.

NSERC

Two NSERC programs can support companies:

- Idea to Innovation (I2I) Grants These grants accelerate the pre-competitive development of promising technology originating from the university and college sector, and promote its transfer to a new or established Canadian company. The funding can be used for market assessment, or R&D activities focused on developing the design, proof of concept and prototyping. NSERC covers 50-100% of eligible costs (equivalent to $15K - $350K CAD). Researcher-owned companies are considered on a case-by-case basis.

- Alliance Grants These grants support university-enterprise research collaborations, providing $20K-$1M over 5 years (50-100% matching of company funds). There is also a pathway towards a joint Alliance Grant and Mitacs Accelerate application.

A researcher’s company cannot normally participate as a partner organization in a project where the researcher is the applicant, co-applicant, or other participant with financial authority on the grant. However, such a researcher-owned partner organization may be able to participate if these individuals and the academic institution can be deemed sufficiently independent from the partner organization’s management and operations, and if they and their relatives (if applicable) do not have a combined controlling interest in the partner organization (i.e., combined, or sole ownership must be less than 30%). You must discuss the specific situation with NSERC before applying.

Innovate BC

Innovate BC is an agency of the province supporting entrepreneurial activities. Programs include:

- Ignite R&D grants, which provide up to $300K for R&D relating to natural resources or applied sciences with TRL 3-4 involving a company and an academic with a 3-year timeframe to go to market (2:1 matching of industry contributions with a maximum 50% of the matching from in-kind sources)

- Digital Skills for Youth provides $25.5K to hire professionals under 30 years of age for an internship up to six months. The internship should be in a technology-related position or supporting digital work where the Intern can develop on-the-job experience in the areas of: AI, Automation, Big Data, Digital Marketing, Programming/Coding, Cybersecurity, UI/UX, AR/VR, or 3D Printing

- Venture Acceleration Program helps BC tech entrepreneurs accelerate the process of defining a proven business model

- ScaleUp program supports companies that have completed product market validation and are ready to focus on ramping up product development, manufacturing, marketing and sales, as well as scaling their organizations and business opportunities to the point where their growth is self-sustaining

- BC Fast Pilot program helps regional SMEs design, build, and operate a pilot plant or small demonstration of their technology in real-world conditions

Digital Skills for Youth program

Digital Skills for Youth is a Government of Canada program which provides ~$20K in wage subsidies to hire professionals under 30 years of age for an internship up to six months. The following organizations are delivery partners for this program:

Please refer to this list of participating organizations on the Government Portal.

Canada summer jobs

This program provides wage subsidies (50% of minimum wage) to employers from not-for-profit organizations, the public sector, and private sector organizations with 50 or fewer full-time employees, to create quality summer work experiences for young people aged 15 to 30 years. Find out more.

WorkBC Wage Subsidy

This program provides a subsidy of 50-75% to cover wages for recently hired employees.

Find out more and how to apply.

National Research Council of Canada Industrial Research Assistance Program (NRC IRAP)

This program provides advice, connections, and funding to help Canadian small and medium-sized businesses increase their innovation capacity and take ideas to market.

Support available includes:

- Funding for youth internships of 6-12 months

- Technology innovation funding

- Advisory services

NRC typically requires your company to have a full business plan and be ready to market. The first step is to call NRC and talk to an intake representative. They will follow up with a template document that you need to complete (outlining your technology, the market, and the opportunity). This will be followed by an interview with an NRC Industrial Technology Advisor (ITA) who would provide feedback and assess if you are ready for their program or are too early.

Scientific Research and Experimental Development (SR&ED) Tax Incentive Program

Canadian companies performing research and development can get the first $3M of eligible expenses claimed as refundable tax credits at the rate of 10% in BC and 35% federally, which adds up to the total 41.5% rate. More information about the program can be found on their site.

For a project to be eligible, it must try to remove technological uncertainty through scientific methods. Provided that a project is eligible, all in-house direct costs, such as salaries (gross) and equipment, are eligible at 100% rate and consultants are eligible at 80% rate (exclusive of GST). Salaries can incur 55% overhead, to which any reasonable expenses of the company can be attributed. Third-party costs are eligible at 100% rate. Mitacs may be either third-party or consultants, depending on the details.

SR&ED claims require extensive documentation, which needs to be made available for an audit if one is made. This includes a project description for each project and more crucially: an account of work done, made on an ongoing basis. Typically, Asana tasks, GitHub issues and commits, and progress reports would be sufficient if suitable processes are in place. It is not important whether the project was successful, but it is important that a systematic approach is being used rather than trial-and-error. In practice, we should engage a consultant to set up the reporting processes as soon as we hire employees.

SR&EDs are claimed with tax returns after a fiscal year ends. It usually takes a few months to prepare the returns, but the process can be expedited if needed. Once the return is filed, if it gets accepted a cheque would typically arrive within 2-3 months. If there is an audit, it would typically take 4-7 months and require interviews.

Other support

- entrepreneurship@ubc

- Creative Destruction Lab Vancouver

- Hatch Accelerator

- BC Tech Association (Free or $500)

- International Trade Council (free)

- Canadian Trade Commissioner Service (free)

- Canada’s Digital Supercluster (Free or $5000)

- Business Development Bank of Canada

- ISED Business Benefits Finder

- Google for Startups

- StartupGrind

- StartupCan Business Owner’s Toolbox

- NYU Startup Toolbox

- Synapse Startup toolkit

- MaRS Startup Toolkit

- Techstars Entrepreneurship Toolkit

- Case Western Reserve Startup Toolkit